Record-Breaking SIP Inflows:

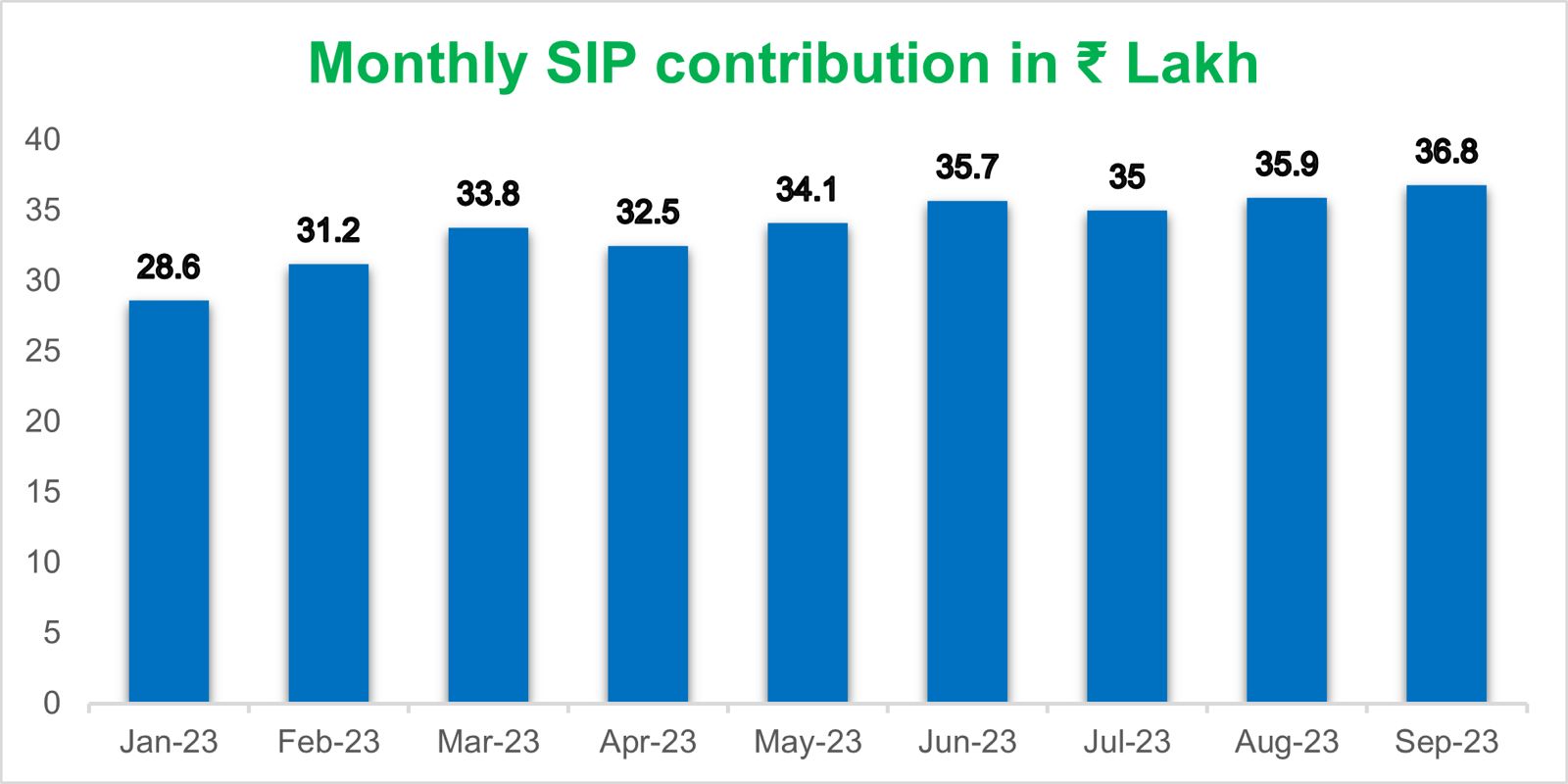

“Picture This: the Indian investment landscape is undergoing a seismic shift. In September 2023, SIP (Systematic Investment Plan) inflows reached a record-breaking high of INR 16,749 Crore, according to the Association of Mutual Funds in India (AMFI). What’s more, 36.77 lakh new SIPs were registered during this remarkable month, eclipsing the preceding month’s 35.92 lakh additions. This surge in SIPs coincided with the BSE Sensex hitting an all-time high at 67,927.

As we delve into this financial phenomenon, we uncover not only the astounding statistics but also the deeper dynamics at play. SIPs, with their structured and regular investment approach, are becoming the go-to strategy for entering the equity market. But beneath the headlines and the surging numbers, there are essential insights to grasp for both seasoned investors and those contemplating an entry into this journey.

This article takes a closer look at the story behind the numbers and the factors that should be considered in the midst of this investment frenzy.”

Understanding SIP:

SIP, also called a Systematic Investment Plan is a way an investor allocates a fixed amount of money at regular intervals to buy mutual funds. This can be weekly/monthly as is decided by the investor. So it means that every X date of the month a certain value of Rupees will be used to buy units of your selected Mutual Fund. This is a good way to enter the equity markets in a disciplined and regular way.

FOMO: The Market Entry Trigger:

These are good signs indicating more investor confidence in the markets but beyond the statistics let’s understand a few important points that need to be looked at if you are someone who is also on this list or contemplating to, looking at the media hype and positive news.

When the market hits a high, that is when a record number of people enter, why is that? Clearly the factor of FOMO, also called the Feeling of missing out. People will hear their friends, and the media and then start rushing to be part of the bandwagon, expecting more gains and that too, very soon.

Market Cycles and the Wise Investor:

If you see just a few months back, in March 2023 is when due to global uncertainties and the Russia- Ukraine war the markets took a hit and we saw a correction. Isn’t that the time a wise investor will say- well this is the time to start adding in phases, hence the SIP to start? But that is when FEAR is high and people are finally emotional, so just stay away. Those who started then may even be up by 30% on their investments! Buy when others are fearful- as goes a famous saying but followed by the few.

The Power of Discipline:

If you enter now, just remember that you are entering when valuations of stocks, especially the mid and small-caps have hit a high. Recently some brokerage houses in fact stopped taking money in the small cap Mutual funds they have, because they just cannot buy anything and justify its value.

This does not mean it’s the WRONG time to enter or start a SIP, it’s just that having the emotional stability to continue the SIP when a fall comes is essential. In the recent past the trends indicate that investors are showing resilience but remember that this is a trend since 2020, when the markets have only risen. The resolve is tested when you see NO growth for a year or more and probably value erosion. That is when the SIP really give you the real benefit, which means investing at regular interval, for the long run and staying disciplined.

There is no fixed formula and one can tweak this as per your comfort but the key word is discipline. For example- some people increase SIP on the way up, and some increase it on the way down. The idea is that you cannot time the markets, and embrace volatility. The long run means at the very least 10 years, that is when you see the real benefit of your discipline in the markets.

Timing the Market vs Time in the Market:

Should you start at the top or wait for a fall? The answer is that based on statistics, it really does not matter as long as you stay disciplined in the long run. The key over there is not WHEN you entered, but how long did you keep your SIP going and how many years did you let your money stay in the market? To verify these statistics numerous studies have been done. You can refer to research by WhiteOak Capital AMC titled ‘Which is better: starting SIP at the Top or Bottom?’ or explore related news articles.

Invest in India’s Growth:

I have a simple message and that is something I would like to leave the reader with- If you believe that the Indian economy will grow overall in the next 15-20 years irrespective of global uncertainties, troubles etc then just invest a part of your income and focus on growing your skills to earn more.

Take Aways:

- Identify your financial goals and why are you investing.

- Formulate a plan as to how much money you have spare and which you do NOT need for at least 10 years and allocate that every month, irrespective of what’s happening in the financial world.

- Do some basic research into your risk appetite and find out the right mutual funds which serve your needs.

- Cut out the noise (media, advice from friends) when you have the plan in place and continue investing your surplus.

- Monitor your portfolio and check the performance of the funds maybe every year.